Today I am discussing the five reasons why I believe Roth IRA Distributions will NEVER be taxed. Why? Because there are many Americans who refuse to use a Roth IRA because they believe eventually the government will go back on its promise and tax all those gains when they are distributed to live on in retirement.

I hear this so often, it’s in my opinion the number one reason why Americans decide NOT to use a Roth 401k or Roth IRA.

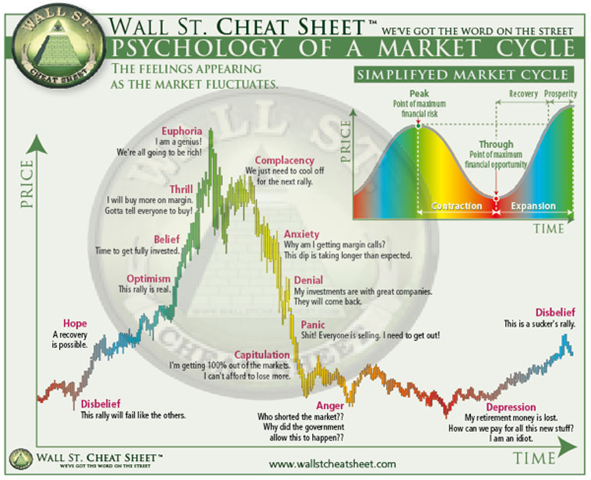

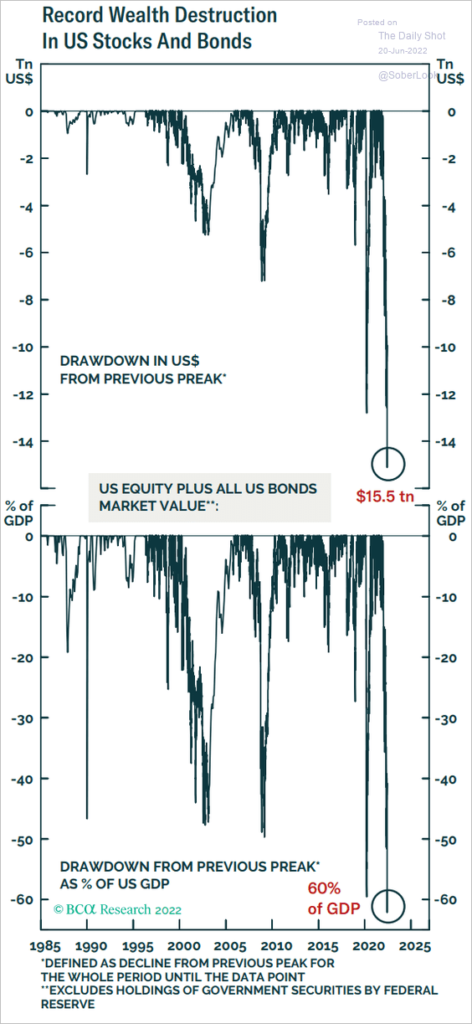

On the surface, this argument makes sense. Many Americans have significant untaxed gains sitting inside Roth IRA and Roth 401k accounts. Our government has borrowed an insane amount of money, interest costs are rising and they could really use the tax money to pay the bills.

But, let’s dive a little deeper.

What is a Roth IRA?

First, it’s important to understand what a Roth IRA is. A Roth IRA is a type of individual retirement account that allows contributions to be made with after-tax dollars. This means that you won’t get a tax deduction for your contributions, but the money you put in and any earnings it generates will grow tax-free. And when you reach retirement age, you can withdraw your money tax-free as long as you are at least 59 ½ and it has been at least five years since you first began contributing.

Some people think this tax break looks too good to be true. So let me tell you the reasons why the government loves them and in my opinion, will never tax the distributions.

Government Doesn’t Want to Wait to Collect Taxes

The government makes billions of dollars in taxes NOW by offering Roth IRAs and Roth 401(k)s. Because traditional 401(k)s and IRAs are typically funded by employees and employers with funds that give you a tax deduction and lowers your taxable income for the year, the government literally makes no money from them on the way in. They have to wait decades to receive anything, and the government doesn’t like to wait. They want their taxes now.

In fact, in 2023 the government significantly raised the limits on the amount of money that can go into both the Roth 401k and the Roth IRA. Now it also allows you to receive your company match in Roth funds if you prefer! This allows the government to tax more money now and worry about future needs, well, in the future.

Without Tax Free Withdrawals, Roth IRAs Wouldn’t Exist Anymore

Number two, if the government decided to tax Roth IRA withdrawals, no one in their right mind would contribute to them anymore. The government would surely lose all the current tax revenue they are receiving by offering the Roth. Tax-free withdrawals are the incentive that gets people to save now and pay that tax now. Take that away and it’s worse than every other already existing retirement plan alternative.

A Great Savings Incentive

Number three, Roth accounts provide an attractive incentive to get individuals to save for their retirement. This reduces the burden on the social security system which is already underfunded. By incentivizing people to save their own funds for retirement, social security can likely last longer than originally planned.

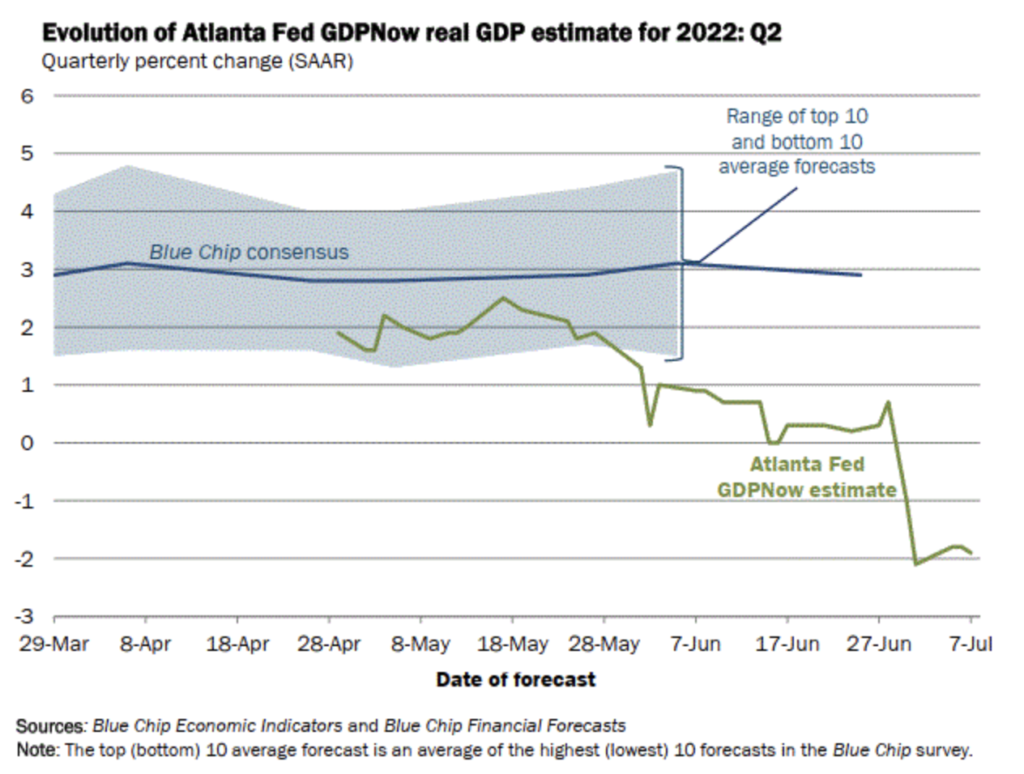

Shortsighted Budgets

Number four, the government budgets are generally for the shorter term not the next fifty years. I don’t know the details of government budgeting but tax revenue received from people making Roth contributions or Roth conversions is revenue the government can count on right now and put into the budget.

Millions of Angry Voters

Number five, As of 2020, 20% or 26.3 million Americans have a Roth IRA. Roth IRAs have been around for over 20 years and have been widely adopted by individuals and financial institutions. Changing the rules now would disrupt the plans of millions of people who have based their retirement savings on the current tax laws.

I believe Roth IRA distributions will never be taxed, but even if Roth IRA distributions do get taxed, existing funds in existing accounts will most likely be unaffected. For fun, just read some of the tax code, it is littered with prefixes pre and post followed by a date. Like, “Post 2030, anyone who opens…”This would almost certainly be the case with a retirement plan used by so many Americans.

In my opinion, if the government does make changes to the plan it will further and further restrict access to it for future generations and higher income individuals.

Either by restricting who can contribute to them, how much they can contribute or both. If anything, the government could restrict them so that no one can contribute. I believe it’s best to fund Roth IRAs and Roth 401(k)s if appropriate for your financial situation before you aren’t allowed to anymore.

Cheers!

Colin Exelby, CFP®

Celestial Wealth Management, LLC is registered as an investment adviser in the State of Maryland and Texas.

Neither the information nor any opinion constitutes an offer or an invitation to make an offer, to buy or sell any securities or other financial instruments.

This video is not intended to provide personal investment advice and it does not take into account the specific investment objectives, financial situation and the particular needs of any specific person.

Investors should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment and planning strategies discussed in this video and should understand that statements regarding future prospects may not be realized.

Nothing provided here constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments.

Investments in securities entail risk and are not suitable for all investors. This is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction. All investment strategies have the potential for profit or loss.

The post Are Roth IRAs Safe from Government Taxation? appeared first on See The Forest Through The Trees.

.

.