There is a right way and a wrong way to do almost everything. Of course, financial planning is very nuanced and often specific to your own situation. But, if you own a business AND have children under the age of 18 do not give them a dime until you watch this video or read this post. I will teach you how to strategically hire your child to get tax breaks in the business now and create a tax-free nest egg for your child forever.

On the IRS’s own website it says: “One of the advantages of operating your own business is hiring family members”.

While hiring a child may not be the first thing many business owners think of, if you do it properly, there can be many tax benefits to doing so.

I’m Colin Exelby, and I am the owner of a virtual financial advisory practice, Celestial Wealth Management. My two children see all the work I put into building the business and guiding clients to keep more of what they earn. One of my goals is to instill that entrepreneurial spirit into each of my girls. My oldest currently has three businesses and recently opened her first bank account to hold the earnings. My youngest… not so much… yet.

If you have a child, be sure to check out my video on Banking 101: Opening First Bank Account for a Child

Having my children work in the business as early as possible has many advantages. We get to spend more time together. I can help them create solid work habits and time management skills. But, most of all, there are several tax benefits that may be available when parents hire their minor children to work in the family business.

These benefits have been around for hundreds of years back to the days when children worked on the family farm. There aren’t nearly as many family farms as in the 1880s now but there are many individual businesses that can use the strategy just the same. Of course, you can’t hire your children, pay them and not have them do work. This only applies if your child is paid a reasonable wage for performing work directly related to your business. If your children are dependents and under the age of 18, it’s important to follow the correct procedures.

What age can a child begin work in a business?

Tax Court has upheld that children as young as seven can work in a business as long as child labor laws are followed.

How much can they earn tax free?

The Tax Cuts and Jobs Act (TCJA) roughly doubled the standard deduction to help those in lower tax brackets. This means children are able to have more income than ever taxed at the 0% rate! The largest benefit to hiring a minor child is to shift income from the parent’s higher income tax bracket to the child’s lower brackets.

In 2021, the standard deduction for individuals (including children) is $12,550. A family where a parent owns a business and is in a fairly high tax bracket can stand to have quite a tax savings by paying the minor child in the 0% Federal bracket.

What about the Kidde Tax? Well, the dreaded “Kiddie Tax” is not a factor because that tax is only on unearned income like capital gains, dividends, and interest. Income generated from working is earned income so the “Kiddie Tax” doesn’t apply.

Let’s look at an example of how to get potential tax breaks hiring your children:

Scott owns a successful boat dealership. (You have heard that boat and RV sales have gone through the roof). Scott is currently in the 35% tax bracket, and has three children, ages 10, 12, and 16. Scott decided to hire each of his children to work on and off during the year. They performed legitimate work like cleaning, and prepping boats, filing and doing data entry, doing deliveries, and a little modeling on the company’s social media and website. Scott paid them each $12,400, the deductions would reduce his 2020 taxable income by $37,200 ($12,400 x 3 = $37,200), lowering his own taxes by $13,020 ($37,200 x 35% = $13,020).

Even better, if we assume that Scott’s kids don’t do any other work (and how could they when they spend so much time with Dad), the entire $12,400 salary paid to each child is 100% Federal-income-tax-free! This means it’s a true family tax savings of the same $13,020

If Scott is contributing to an education account for his kids, going to give them an allowance, or is putting away money in a savings account for them, this is a much better and more tax-efficient way of doing it

If you own a business that is close to the new qualified business income (QBI) deduction phaseouts the tax savings can be even better! The salary is a business expense that can lower the business income to the point of receiving a larger QBI deduction. Getting Uncle Sam to help with your college education funding or splitting an allowance with you is very nice.

What procedures should you follow when hiring a child under 18?

When employing your child you want to make the process is as audit-proof as possible. You will want to keep a timesheet showing the dates and hours worked, services performed, along with proof of payment and receipt of payment. You can’t pay in pizza slices and cans of soda.

To start off, fill out a form W-4 for your child for your records.

Next, create a job description and informal contract between your company and your child. Create a spreadsheet to track dates, times worked and services performed.

According to the IRS website, wages of a child under age 18 who works for his or her parent in a trade or business are not subject to social security and Medicare taxes if the trade or business is a sole proprietorship or a partnership in which each partner is a parent of the child. If you are running a small sole proprietorship or partnership get off and running. If you have an S Corporation we will get to you in a minute.

From my discussions with CPAs as well as my own independent research, there is some conflict on whether you actually need to issue a W-2 from the business for your child. Because you are not required to withhold FICA, FUTA, or SUTA taxes for your dependent, minor child there is an argument to be made that a W-2 doesn’t need to be issued. You could, as a business owner write off the expense as “outside labor” to get the deduction and be done with it.

In my opinion, even though the wages of the child under 18 are not subject to social security and medical taxes it still is a good idea to file the W-2. The W-2 is one of the ways you can sufficiently document your child receiving earned income. The records you keep including the job description and timesheet are typically all the proof you need but in my opinion, the W-2 is the cherry on top.

How should your child receive the funds?

As I stated above, you don’t want to pay your child with pizza and soda. Check out this often-cited story where a business owner paid their children in pizza because that is what they preferred. The tax courts frowned upon this strategy.

Ideally, you want to have your child on your payroll and pay funds directly to a bank account in their name. Since they are a minor that would most likely be a custodial account for their benefit. This helps to close the loop and show receipt of payment. In addition, the account makes it much easier to fund the savings strategies I will outline later.

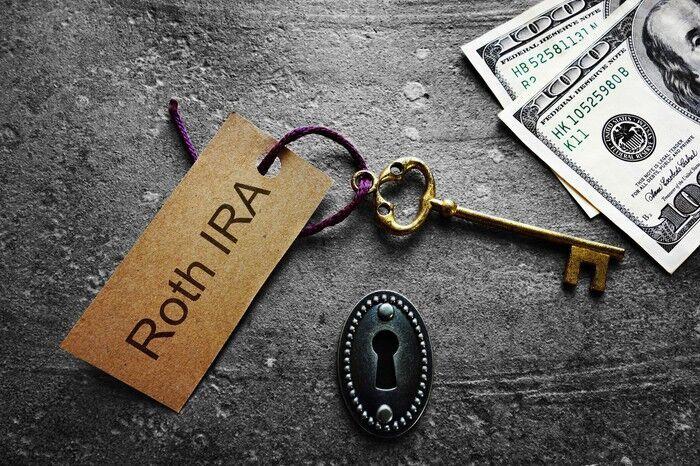

Does your child need to file a tax return since they are earning money?

Your children, who often make less than the standard deduction most likely do not need to file a tax return. This is the questionnaire used by the IRS to determine if you need to file a tax return. In the vast majority of cases, no return needs to be filed because the income is less than the standard deduction. It is possible they would need to file if their unearned income was greater than certain amounts or they were eligible for different tax credits. If you’re unsure if your child needs to file a tax return, talk to your qualified tax advisor.

Even though the child’s wages aren’t subject to FICA taxes, they are still subject to federal withholdings (unless the child is exempt) so the child should ideally receive funds from payroll and a W-2 from the business. Those funds should actually be deposited into an account for them to complete the cycle. In my opinion, this helps prove earned income, which can be valuable later in this process.

What if you don’t have a sole proprietorship or partnership?

If you run an S corporation or C corporation, you are not eligible for special employment breaks on FICA taxes. So, if you own a corporation, you ideally don’t want to pay your children from the company. But there are other options.

One of the most common ways is to create a separate sole proprietorship or partnership family management company. This separate entity IS ELIGIBLE for the FICA tax savings because it is a sole proprietorship or partnership. The family management company would hire the children and contract a fee with your S Corporation to provide the services.

If you pursue this more sophisticated approach to paying your children, be very vigilant in maintaining proper books and records.

- Make sure to have a copy of the contract between the family management company and the company hiring the children.

- If the family management company were able to provide those services to another non-family-related company that would provide additional validity.

- Since the family management company is the actual employer of the children, payroll and W-2s should be run through that company and likely a tax return.

It is possible that for some business owners this extra work could outweigh the monetary benefits.

What about hiring your child who is over 18?

If you are paying children 18 or older, you have the option of treating them as subcontractors or as employees. If you decide to pay them as a subcontractor, just issue them a 1099 in January like any other subcontractor. Just remember, that if you hire them as a full-time employee of the company they must be treated like one. No special treatment.

They would file a small-business Schedule C, get to take small-business tax deductions, take a standard deduction of $12,550 in 2021 (adjusted for inflation each year) and will probably be in a lower tax bracket than you. This can provide tremendous tax savings to the company.

As children get older, in my opinion, having them involved in the business on a Board of Directors or Board of Advisors (if an LLC) can provide many benefits both financial and otherwise.

Where to Invest the Funds

Now that you have properly hired your children in the business for legitimate work and have set up payroll, where do the funds go? First, there should be a bank account that would receive the funds. This helps complete the circle, from business expense, to payroll, to receipt of funds.

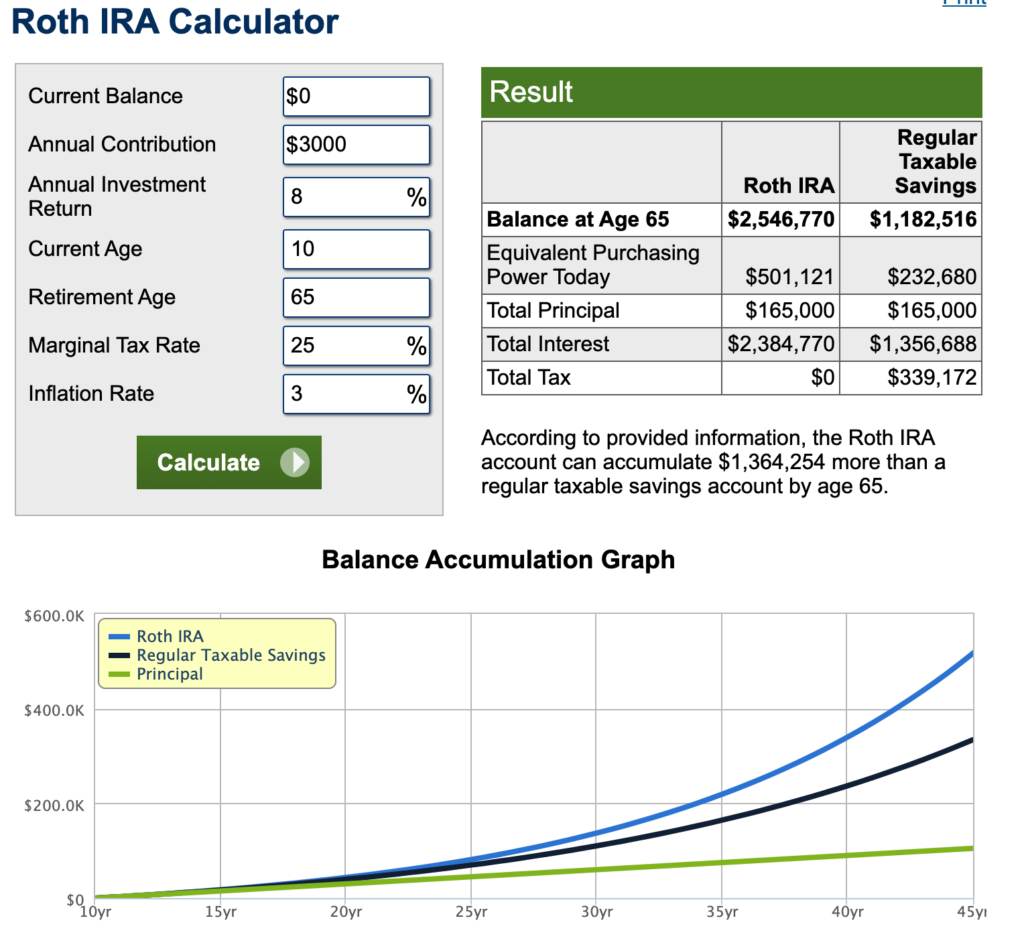

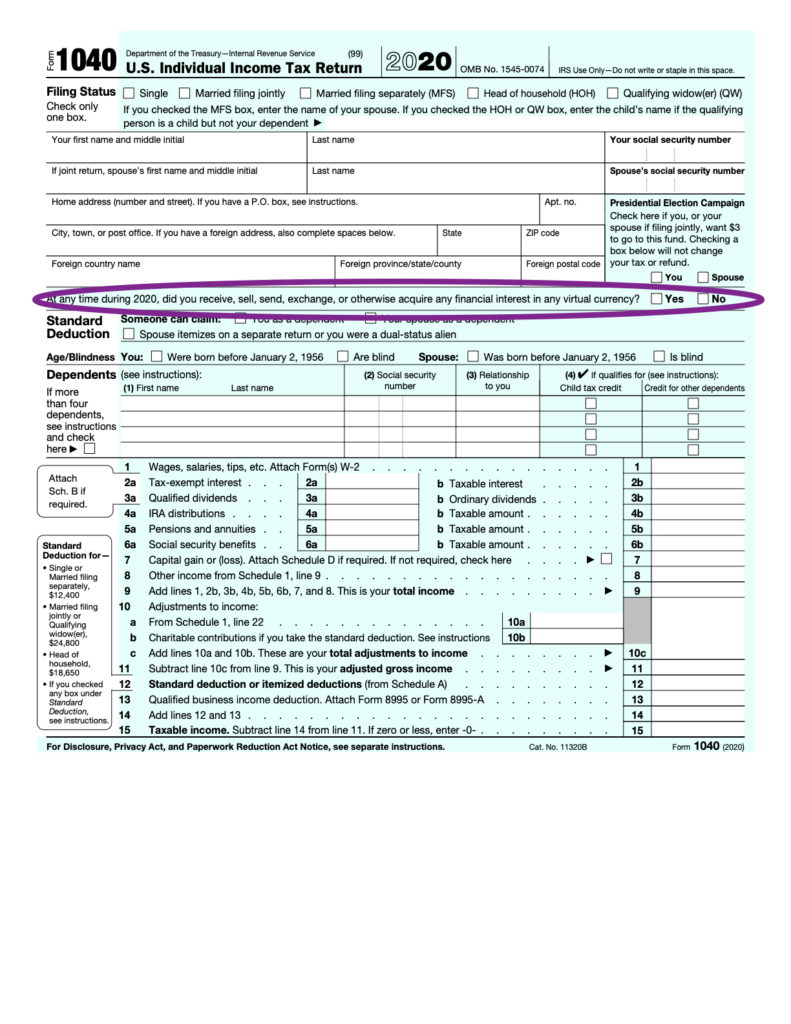

Should you just leave the funds there? Heck no! This is where the real benefits of this strategy kick in for your child. In my opinion, the #1 place to begin the accumulation of funds is in a Custodial Roth IRA for the benefit of the minor child. We have no idea what future tax rates will be, but a Roth IRA allows one to contribute after-tax funds (which these would be), have the funds grow without taxes, and then take the funds out without taxes (as long as a few rules are followed.

Because your child would be in the zero percent tax bracket, this is a way for you to turn a below-the-line savings strategy into an above-the-line business expense and a triple tax-free benefit for your child’s future! In order to make a Roth IRA contribution, an individual must have earned income AND it must be below a certain income threshold (currently in the six figures adjusted annually). In 2021, they would be eligible to make a contribution of up to $6,000 or the amount of earned income they had whichever is lower.

This “small” amount of savings can really add up over time to potentially large sums of tax-free money for future use. Just take a look at this hypothetical example.

In addition to the Roth IRA, you could direct the earned income into an education fund for college or a private high school. The after-tax funds contributed (at the child’s 0% rate) could be invested in a 529 Plan and grow without taxes. As long as they are used for qualified educational costs of either private high school, trade school or college, the distributions are also tax-free.

Now, you the business owner get a tax deduction for paying your child to work for you… money you were going to give to the child anway. They don’t pay any tax on the income (if less than the standard deduction) and don’t file a tax return. You can take those funds and contribute to their future retirement via a tax-free Roth IRA or their college education via a tax-free 529.

WHOA! That sounds like a plan!

These are two excellent ways to create potentially tax-free wealth for your children while instilling in them life skills such as time management, entrepreneurship, and work habits while also getting to spend more time with your family.

One item I do want to make note of is the potential impact on Financial Aid. Typically, 50% of a student’s income is counted toward their expected family contribution (EFC) when applying for financial aid. But, for students entering college in 2021, the first $6,970 of income is exempt from the FAFSA calculation. That amount generally increases by about $100 per year. This is relevant for children who are at least sophomores in high school because these are the years that are used to calculate financial aid.

If you have any questions on how you could potentially employ these strategies visit my website at https://www.celestialwm.com or speak with your CPA.

Colin B. Exelby, CFP®

This is general tax information and hasn’t considered your personal tax situation. It is based upon current tax information available in April, 2021. This information should not be relied upon as tax advice. Please consult your tax professional. This information is for educational purposes only. The solutions discussed may not be suitable for your personal situation, even if it is similar to the hypothetical example presented. Investors need to make their own decisions based on their specific investment objectives, financial circumstances, and tolerance for risk

The post How to Get Tax Breaks by Hiring Your Children (The Right Way) appeared first on See The Forest Through The Trees.

professional, I was also able to add a unique perspective to her article. The article is titled Families Get Crash Course in Remote Learning and is up on the

professional, I was also able to add a unique perspective to her article. The article is titled Families Get Crash Course in Remote Learning and is up on the